Quick Funding, Easy Flexible Payment

Embedded finance. The term is popping up everywhere. What is embedded finance, and what does it mean for you?

A simple example would be adding an alternative financing option to your website to give your prospects a frictionless way to purchase your products and services.

A new study from Juniper Research found that revenue from embedded financial services will exceed $183 billion globally in 2027, increasing from just $43 billion in 2021.

Like all products and services, well-established companies can use their trusted corporate identity to give their alternative financing solutions a boost, as consumers see them as safe, reliable, and trustworthy.

B2B Embedded Finance – An Untapped Market

Juniper’s research found that embedded financial services are not readily available within B2B markets, resulting in a significant untapped opportunity for businesses to grow their revenue streams by incorporating embedded finance solutions.

However, there is a caveat. Businesses wishing to offer embedded finance must choose the right partner and suitable offerings that solve genuine challenges for their customers, or they will lose out to their competitors.

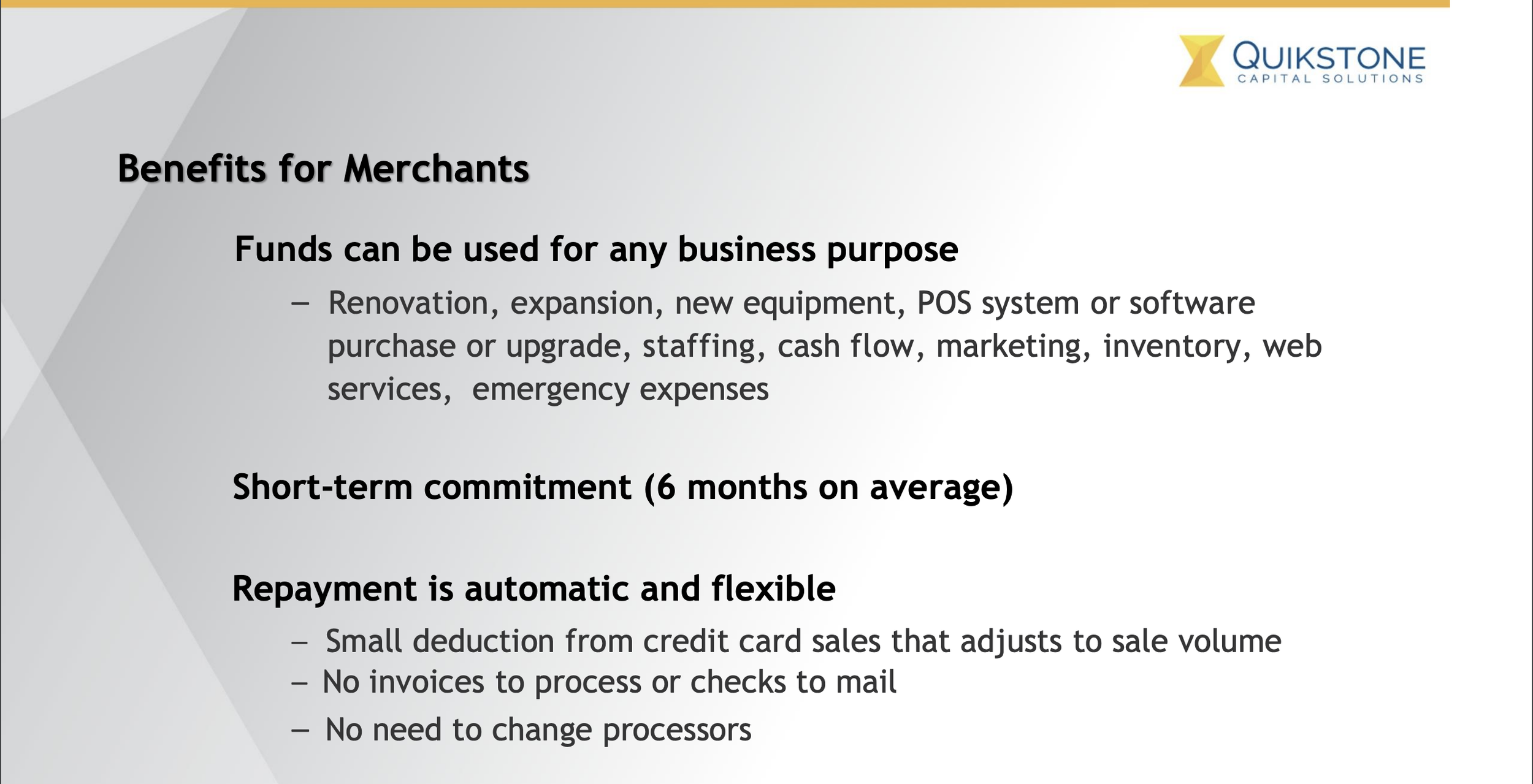

Quikstone Capital Solutions is an innovator in embedded finance. With an A+ rating from the Better Business Bureau and a renewal rate of over 80%, you'll find Quikstone to be a reliable, transparent, and trusted partner.

Quikstone makes it easy.

Quikstone provides its partners with everything they need to create an embedded finance solution that keeps funding top of mind with their merchants. As a Quikstone partner, you'll receive a link to a custom-branded application to embed in your website or merchant log-in.

“If you’d like to know more about partnering with Quikstone and adding embedded finance to your online presence, contact us today.

I look forward to speaking with you!

Serena Smith

Director of Partner Development

Quikstone Capital Solutions

Mobile (919) 671-4296

Serena.Smith@QuikstoneCapital.com

www.QuikstoneCapital.com”

How Kiosks Can Help You Fight Inflation

For more than a year, small businesses have struggled to fill open positions. According to a survey from the Alignable Research Center, roughly 45% of small businesses are putting hiring on hold due to higher salaries, inflation, and the fear of recession.

There is help for these businesses, and it’s coming in the form of new technology. By taking on the work of several people, self-ordering kiosks can cut labor costs and allow existing staff to focus on more meaningful duties. Whether free-standing, wall-mounted, or table-top, self-ordering kiosks are helping businesses, especially restaurants, battle today’s high costs and record inflation.

Kiosks Cut Costs - In addition to driving down labor costs, kiosks help small businesses make money. Automating two essential front-of-house tasks (ordering and payment) reduces the number of staff needed per shift. With a one-time investment in a kiosk, all ongoing labor costs like salaries paid leave, perks, and incentives are eliminated. Kiosks are also much faster than humans, facilitating higher volumes, and this speed is a real benefit during peak times when there are long lines of customers.

Kiosks Equal High ROI - Because of the increase in ticket sales that using kiosks yields, restaurants can make a quick return on their investment. Kiosk orders, on average, are 10-30%higher than orders placed with a cashier. The revenue from self-service kiosks will hit $14 billion in 2022, up from $10 billion in 2017. Attractive displays, automated cross-sell and upsell options, and faster checkout all contribute to higher spending. Restaurants typically expect increased revenues of $20,000 to $40,000 within several months of use. Thanks to this increase in sales, the system pays for itself in a short time, with the profits going straight to the bottom line.

Kiosks Provide a Wealth of Data - Foodservice kiosks help restaurants learn valuable information about their customers and their spending habits. Merchants can use this data to target promotions, increase sales, deepen customer satisfaction, maximize discounts and plan more efficiently.

By identifying customer demand and preferences, business owners can offer items that are guaranteed to sell. Purchase patterns based on time of day, week, month, or season, can reveal peaks and drops in demand, allowing for proper inventory planning. Businesses can then manage their spending and reduce costs by buying more effectively.

Finding the Right Kiosk for You - For a small business, the best response to today’s economy is to take steps to reduce costs. Adding kiosks to your business can be one of the most effective tools to cut expenses, combat inflation, and increase revenue.

Since 2005, AST POS has helped merchants of all types and sizes with the latest technologies – including self-service kiosks - to run more efficiently and increase revenue. AST POS kiosks are affordable, secure and reliable. If you don’t have the cash on-hand to purchase a kiosk from AST-POS, Quikstone Capital can help.

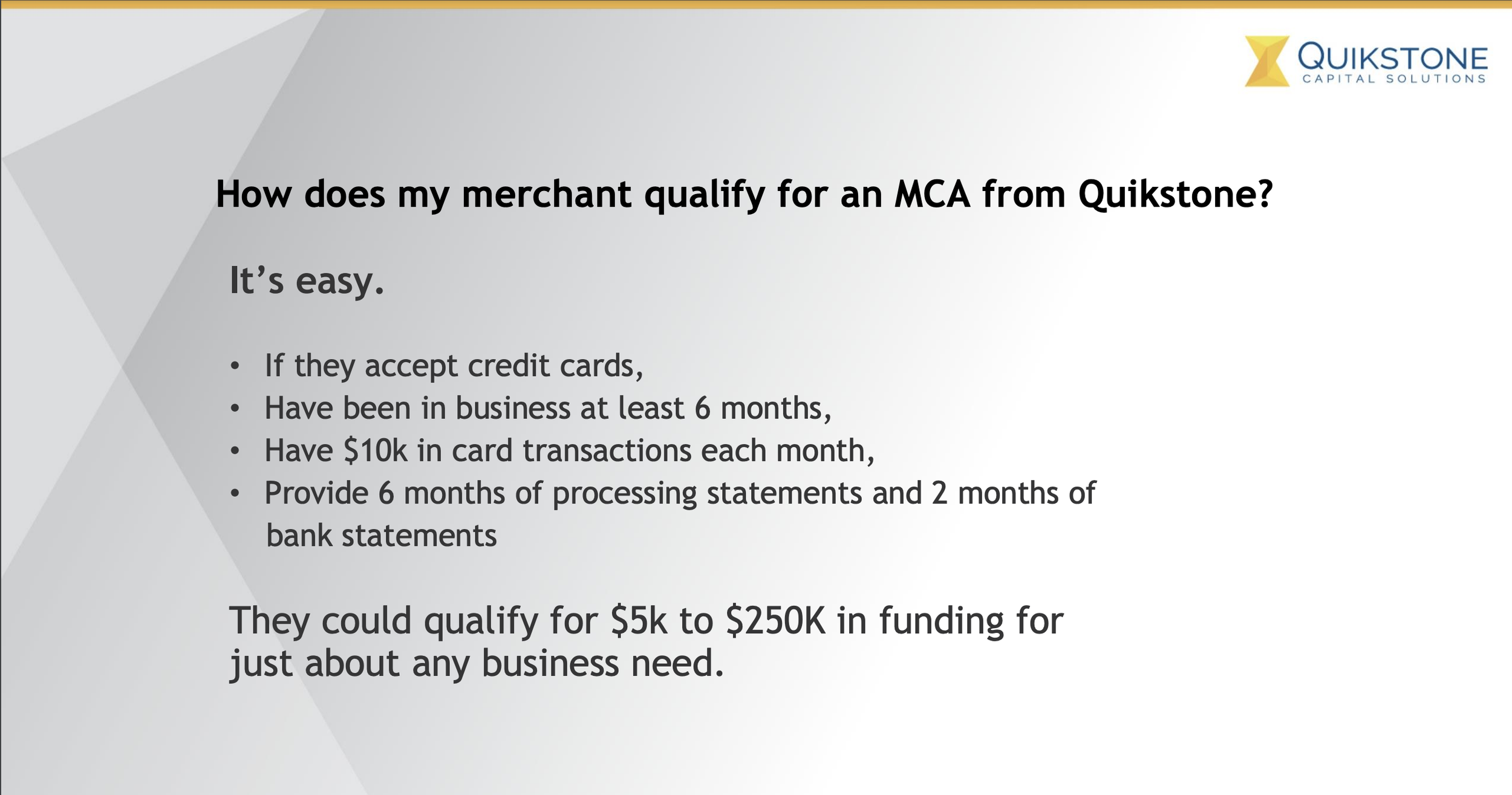

Since 2005, Quikstone has provided easy, fast, and flexible working capital to businesses just like yours. Quikstone funding is not a loan; it is a purchase of a small portion of your futurecredit card sales. There is a simple one-page application, and no collateral is needed. If you process credit cards, you could qualify for $250,000.

Quikstone has an A+ rating with the Better Business Bureau, and 80% of our merchants arerepeat customers. Use our ROI calculator to determine how a cash advance from Quikstone fora self-service kiosk can help your business grow. Contact us today to get started. There is nocost or obligation.

7 Steps to Help Your Business Fight Inflation

Today, many small business owners continue to feel the squeeze of high prices. According to the Bureau of Labor Statistics, significant increases in food, shelter, and gas prices drive high inflation.

When costs rise, and profit margins shrink, merchants must act to keep their businesses profitable.

Here are seven actions you can take right now to minimize the impact of inflation on your business.

Know where your business is spending money and cut your expenses. Review your current spending and determine if it aligns with your strategy. If employees are wasting office supplies or delivery drivers are taking the scenic route, address the issue. If your online advertising budget isn’t bringing revenue, make adjustments. Cancel unused products and services.

Stock up on necessary supplies. If there are items you know you will use in the year ahead, front-load that inventory. Purchasing in bulk allows you to avoid future price increases, which means you won’t pass on higher costs to your customers.

Have multiple suppliers. With numerous suppliers, you’ll have options if one can’t get what you need or their prices spike.

Review your products and services. Identify which ones are the most profitable. Remember consumers might be open to lower-priced options to work within their budgets. Consider temporarily eliminating some products, services, or expenses to better focus on what generates the best results.

Raise prices wisely. Don't increase your prices so much that your customers turn to your competitors. Raise your prices just enough to offset inflation and keep your business profitable.

Also, don’t be sneaky about pricing. Be transparent. Let customers know about any price increases and help them understand why.

Prioritize customer service. Don't cut back on customer service by being understaffed. If you don’t have the budget for a full-time employee, add part-time staff.

Use the latest technology. Self-serve customer options can reduce costs and take pressure off existing staff in an already tight labor market. Online ordering and Self-ordering kiosks from AST POS have a great return on investment. Running your business more efficiently will go a long way to fighting inflation.

Since 2005, Quikstone has helped thousands of merchants get through the hard times with easy, fast, and flexible working capital. If you accept credit cards, you could qualify for up to $250,000. Use the funds for any business need, including adding the latest technologies, purchasing new equipment, strengthening your cash flow, hiring employees, and increasing inventory. Try out our ROI calculator to see how a cash advance from Quikstone for a self-service kiosk can help your business grow.

Quikstone has an A+ rating with the Better Business Bureau, and 80% of our merchants are repeat customers. There’s no cost or obligation, so apply today!